Home Sales in Austin Remain Strong Despite

Continued Higher Rates

Housing inventory increases while median sales prices drop

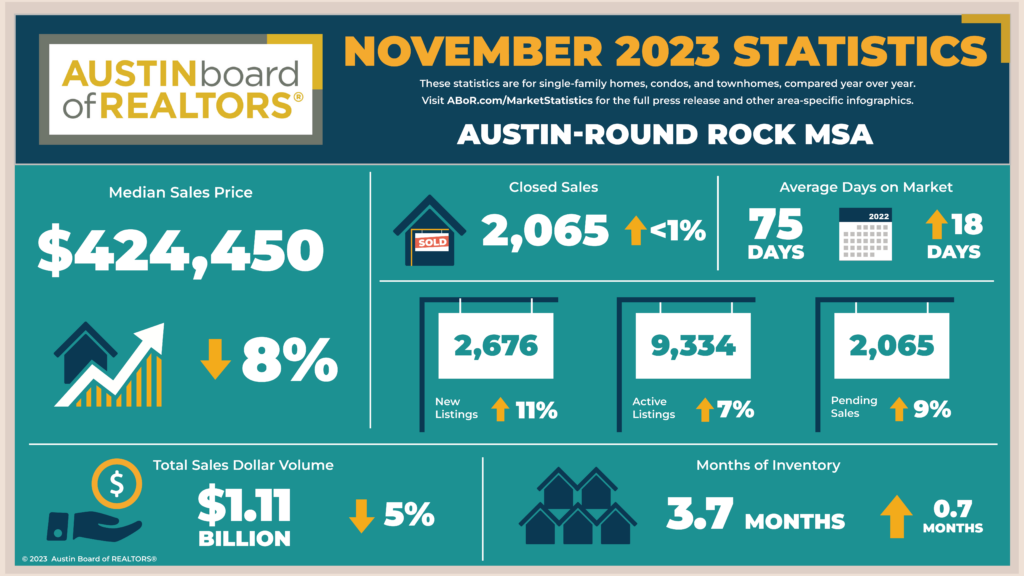

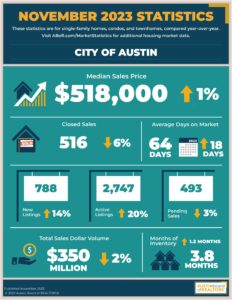

The median home price across the Austin Round-Rock MSA dropped 8.4% to $424,450 last month. Indicating Austin’s housing supply is becoming available at lower price points, but considerably elevated relative to pre-pandemic levels. While mortgage rates remain elevated, the Central Texas housing market experienced a slight increase in residential homes sold across the MSA, rising 0.2% to 2,065 total sales.

“Buyers in Central Texas now have a more abundant selection of homes to peruse than in previous years,” Ashley Jackson, 2023 ABoR president, said. “The drop in median home prices indicates buyers can be a little more selective in the search for a home that checks all their boxes. For buyers actively shopping for a home—and those who have been sitting on the fence waiting for their time to strike— now is the time to contact your REALTOR® and get serious about buying a home.”

Homes spent an average of 75 days on the market, up 18 days from November 2022, while housing inventory increased 0.7 months to 3.7 months of inventory.

Clare Losey, Ph.D., housing economist for ABoR, noted that elevated mortgage rates are contributing to the decline in home prices and an increase in active listings as homes remain on the market for longer. “A rise in mortgage rates reduces buyers’ purchasing power, so the moderation in home prices helped to offset some of the decline in affordability. However, rates peaked in late October and early

November, signaling a rise in buyers’ purchasing power moving into 2024.

“The year-over-year uptick in new and active listings provides buyers with more options, which is a welcome reprieve from the starved market many have endured in recent years. While this current increase in listings gives our market some breathing room, our city should embrace opportunities to generate more housing supply.”

You can read all the details about the current market stats here. You can also visit www.abor.com for more information.

To see a comparison to the Market Stats from November 2022, click here.